The original version of this story was published here in portuguese on July 27

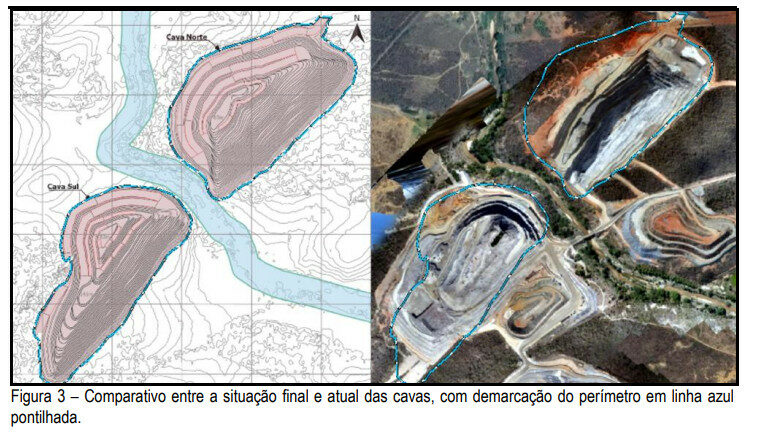

We had exclusive access to examine a whistleblower report received by the Minas Gerais Public Prosecutor’s Office (MPMG), which raises the suspicion that the mining companies Vale and BHP Billiton are staging a dodge to save billions where the biggest environmental disaster in Brazil took place.

The investigated scheme would serve to ensure that both companies, owners of Samarco , could pocket part of the billions that they pledged to pay to repair the dam rupture in Mariana , which occurred in November 2015, when 19 people were killed.

The Renova Foundation, created by Vale and BHP to head remedial actions up for those affected, is being used for possible fraud, as the document points out.

There are indications that Vale and BHP donations to Renova are being recorded as debt contracted by Samarco, intending to return the money to their parent companies. If the suspicions are confirmed, Vale and BHP would be working to pocket the money they theoretically give over to repair the damage they have caused. The Brazilian Federal Revenue Office forbids such deceptive actions.

It is not the first time that Renova have come under suspicion. An investigation opened at the end of January at the Minas Gerais Public Prosecutor’s Office (MPMG) iniciative, to which the whistleblower report was attached, concerning whether the Foundation is being used for purposes other than that which should be their objective (the reparation of those affected) and if Renova operate independently of the mining companies.

According to the report, there are public documents which indicate that Vale’s contracts are being hidden from the market. BHP Brasil, a privately held company, does not need to publish this type of information. After an analysis that allowed the whistleblower report to be accepted in an exceptional case, the MPMG also called the Public Prosecutor’s Office, the Federal Revenue Office and the Securities and Exchange Commission, agencies responsible for investigating tax evasion and other suspicious transactions.

The next steps towards the investigation should include requesting companies’ tax books, which are not available to the public. A tax lawyer who asked not to be identified estimated that, if confirmed, the fraud could exceed R$ 1.5 billion.

The decision signed by prosecutors Gregório Assagra and Valma Cunha, both from the MPMG, requires the Renova Foundation to answer “what is the legal nature and the tax accounting treatment of bank transfers, payments, contributions, donations and deposits made by the supporting companies (Vale, BHP Billiton and Samarco).”

The agreement signed by the mining companies suspended a public civil action in which the Public Prosecutor’s Office charges R$ 155 billion as compensation for the Mariana disaster until August 2020. As the renegotiation process has not even started, the deadline for Vale and BHP to eventually pay something should be expanded by another two years. Another public civil action, in which the federal government had requested R$ 20 billion, was extinguished.

So far, Renova claim to have spent R$ 8.8 billion in reparations , including compensation for victims and environmental reparations.

Amid the covid-19 pandemic, the Renova Foundation also decided to cut off financial aid to seven thousand people in Minas Gerais and Espírito Santo. For this reason, they have just been denounced for a “possible mass violation of human rights” by the Rio Doce Interdefensorial Group, formed by the Federal Public Defender along two states Offices. At least another 17,000 families are still waiting to be recognized as “affected” by the causes of the catastrophe to start receiving the aid. After the complaint, the Federal Court forced Renova to keep the payments.

Yet, Vale, BHP and the subsidiary Samarco operate to save more money at the expense of the victims and those affected. The three companies presented similar responses to The Mining Observatory .

Vale said that “they fully comply with the Brazilian tax legislation and that their taxes and accounting information is available in their financial statements”. Vale also affirmed that “until now, they have not received any communication from the Public Prosecutor’s Office of Minas Gerais regarding tax issues involving the Renova Foundation and Samarco, but is now available to provide any clarifications that may be required by MPMG and other authorities.”

BHP stated that “they work in full compliance with the Brazilian law, following the strictest governance and compliance controls.” and also “As for the alleged investigation that is under the responsibility of the Public Prosecutor’s Office of Minas Gerais, if it is demanded by the competent authorities, BHP will look for their terms before answering it”.

Samarco argued that “they fully comply with Brazilian tax legislation and all taxes due are properly paid.” “The accounting treatment adopted by the company is also in accordance with the Brazilian practices, including the pronouncements issued by the Accounting Pronouncements Committee and approved by the Federal Accounting Council,” and “the company’s tax and accounting information is public and available in their financial statements.”

The Renova Foundation, on the other hand, simply stated that “they will provide the clarifications requested by the Public Prosecutor’s Office of Minas Gerais within the period established by the agency.” Read the questions sent and the responses as we received.

For André Portella, PhD in Financial and Tax Law and professor at the Law School at UFBA -the Federal University of Bahia, the operations reported may not necessarily be illegal, but they have a clear purpose of generating tax savings for companies and transferring losses to the entire Brazilian society.

“These are measures that transfer the values of the restitutions that should be paid by the companies responsible for human and environmental damages to the entire Brazilian society, as these figures will be used to reduce the amount of taxes due to be paid”, he says.

In view of the fundamental issues of compensating the affected families and recovering the environment, the issue of characterization of tax evasion becomes secondary, and it will probably take years to be resolved by competent agencies. The major challenge that must be addressed is effectively carring out the grant, which should be paid exclusively at the expense of the companies accountable for causing the damage, without transferring it to the whole brazilian society, believes Portella.

How it works

Page 43 of the 2019 Samarco Financial Statements shows that the mining company is treating the expenses resulting from the disruption of the Fundão Dam as if they were deductible expenses from the income tax base. The entry can be found under the item “deferred income tax.”

Although it is prohibited by tax legislation, according to the Federal Revenue Office 209/2019 Solution . In it, the agency expressly determines that “amounts paid by agreement made in a lawsuit of which the querent is a defendant (…) cannot be deducted in determining the real profit.”

Samarco’s explanatory notes also record R$ 6.3 billion in the balance sheet referring to “Accounts Payable in the Country” derived from the dam disruption. On December 30, 2016, contracts were signed in which Samarco recognized the obligation to pay their shareholders (Vale and BHP) the amounts delivered by them to the Renova Foundation.

According to an analysis by an anonymous source specialized in the subject, which served as the basis for the complaint of the Public Prosecutor, “Samarco assumes the obligation to reimburse these contributions to shareholders through an unnamed contract that is mentioned in Samarco’s Financial Statements, but does not appear in Vale’s Financial Statements , nor is Vale declared to Securities and Exchange Commission as a related party transaction.”

This would indicate a real departure from Renova’s purpose. In theory, the whistleblower recalls, it is a private non-profit Foundation designed to repair the environment and compensate the victims of the disaster. “But it seems that its real purpose is to save tribute for the maintainers (the mining companies), enabling a cross-operation that would be impossible without the entity.”

This is due to the contract that turns the donation into debt. It allows the return of the capital invested by Vale and BHP, with interest, even with a decision that forbids the payment of dividends to shareholders by Samarco. Thanks to the artifice, what the company is doing is, in accounting language, “debt settlement”, not profit distribution.

The amount saved can vary from 15 to 25% of the total deducted. Applied on the R$ 6.3 billion owed to repair the damage caused by the rupture of the dam in Mariana, these percentages might mean savings of more than R$ 1.5 billion for Vale and BHP.

For Daniela Olímpio, who holds a PhD degree both in law and sociology from the Fluminense Federal University and professor of tax law and tax justice at the Federal University of Lavras (MG), the tax economy through loans and financing is not in itself abusive. But it can be considered abusive if it is the real objective of “atypical contractual practices.”

“In my opinion about the Renova Foundation case, the abuse is that the intent is not just the tax savings, but a certain transfer of the responsibility for asset liability, from the company to the State itself. Or, ultimately, for the taxpayer,” says Olímpio.

For Pilar Coutinho, coordinator of the Post-Graduation in Tax Law at PUC Minas, the 209/2019 Consultation Solution is not binding, but similar to the case reported and sent to MPMG, and may serve as an interpretation for other cases.

“The legislation authorizes the deduction of parcels that are essential to the maintenance of the productive activity. I understand that installments referring directly or indirectly to the financing of the Renova Foundation are not presuppositions for the productive activity, but the consequence of previous conducts. Its deductibility may be questioned by the Tax Authorities and before the Judiciary,” says Coutinho.

In other words: the mining companies will not stop producing because of this and the current Federal Revenue’s understanding is that they could not deduct these expenses from the income tax, as they are not usual expenses for their activities. “Although the operation may be lawful, as will only be known with the deepening of the investigation, it is morally questionable that the current taxation is being reduced with expenses resulting from a tragedy in proportion to what happened”.

Debentures also raise suspicions

In addition to the hidden contracts that cover amounts “donated” to the Renova Foundation, Vale and BHP provide working capital to Samarco by purchasing debentures issued by them.

Debentures are debt securities that generate credit to the buyer. In 2019, Samarco issued debentures as a side effect for loans it took from shareholders Vale and BHP. They report, in their cash flow statement, the payment of interest on loans and financing in the amount of R$ 1 billion and 23 million in 2019 and R$ 708 million in 2018.

According to the technical analysis of the MPMG, “such emissions can constitute a kind of payment for companies even before the liquidation of the damage caused by the disruption of the Fundão Dam. In addition, the financial interest on the payment for the issuance of the debentures reduces the financial income of the company Samarco, which reduces the payment of the Income Tax and Social Contributions.” From an accounting point of view, “this information needs to be investigated to assess a possible situation of tax evasion, ” prosecutors say.

In plain language, the dodge could cause Samarco to pay much less tax than they really should, directly benefiting Vale and BHP with a return on invested capital in the future. What is currently prohibited by a Court decision, which forbade the distribution of dividends by Samarco to its shareholders Vale and BHP Billiton Brasil.

PhDs in tax law, auditors from the Federal Revenue Office and former advisers from the Administrative Council for Tax Appeals, Carf, invited by the report to comment, did not speak openly about the case.

Speaking under the pledge not to be identified, a former Carf board member (a body that judges tax disputes between companies and the federal government before they reach court) said that financing via debentures is at least strange and that the IRS does not accept this type of tax deduction.

Other experts interpreted the suspicions as robust, indicating that the maneuvers deserve a proper investigation.

Renova accounts are targeted by the MPMG

An inquiry already opened by the Public Ministry of Minas Gerais (MPMG) investigates irregularities in Renova’s management, assets and core activities – namely, repairing the damage caused by Mariana’s environmental disaster.

The Renova Foundation’s accounts are being scrutinized with “emphasis on the relationship between budget and fulfillment of final activities.” It is necessary to carry out an independent audit on the taxes collected and the rendering of accounts by Renova, the promoters reinforce.

There is also mistrust about the “adequacy of equity payment and financial contributions” of the Foundation by its sponsors in relation to the repair programs provided for in the Term of Transaction and Conduct Adjustment.

Renova would be acting “ostensibly” in favor of companies, says the MPMG. Among the violations, Renova has demanded from those affected and from city halls to waive legal proceedings against Vale and BHP in Brazil and abroad to pay the indemnities they owe, a situation detailed by me in February 2019.

The MPMG also recalls Renova’s lack of transparency regarding the data and information that must be published and provided to those affected. Repair work collects delays and inefficiencies, and several agreements signed have been breached, prosecutors Gregório Assagra and Valma Cunha say.

Finally, it would be clear that Renova is not independent and autonomous from the mining companies that control them, “in view of the dominance on the Renova Board of Trustees by the companies Vale, BHP and Samarco, which have six seats on the Board, which has prevented the fulfillment of its statutory purposes and of the programs foreseen in the Term of Transaction and Conduct Adjustment ”.

Thus, the Foundation in practice is “submissive” to the private interests of the mining companies, which are responsible for the socio-environmental damage caused by the rupture of the Fundão dam in Mariana.

Despite this, with the return of Samarco’s activities approved by the Environmental Policy Council of the State of Minas Gerais , the expectation is that the mining company controlled by Vale and BHP will soon start operating again in 2020.

O post Revealed: Vale and BHP accused of pocketing money that should grant aid after Brazil’s worst environmental disaster apareceu primeiro em Observatório da Mineração .

Fonte

O post “Revealed: Vale and BHP accused of pocketing money that should grant aid after Brazil’s worst environmental disaster” foi publicado em 29th July 2020 e pode ser visto originalmente diretamente na fonte Observatório da Mineração